The Cost Of Hiring A Tulsa, Ok Bankruptcy Attorney: What To Expect

The Cost Of Hiring A Tulsa, Ok Bankruptcy Attorney: What To Expect

Blog Article

The Role Of Tulsa Bankruptcy Attorneys In Personal Bankruptcy

Table of ContentsThe Importance Of Bankruptcy Education: Insights From Tulsa Bankruptcy AttorneysTulsa, Ok Bankruptcy Attorney: Your Key To A Successful CaseHow To File For Bankruptcy Without A Tulsa Bankruptcy AttorneyThe Bankruptcy Lawyer Tulsa Residents Trust: Our Top Picks

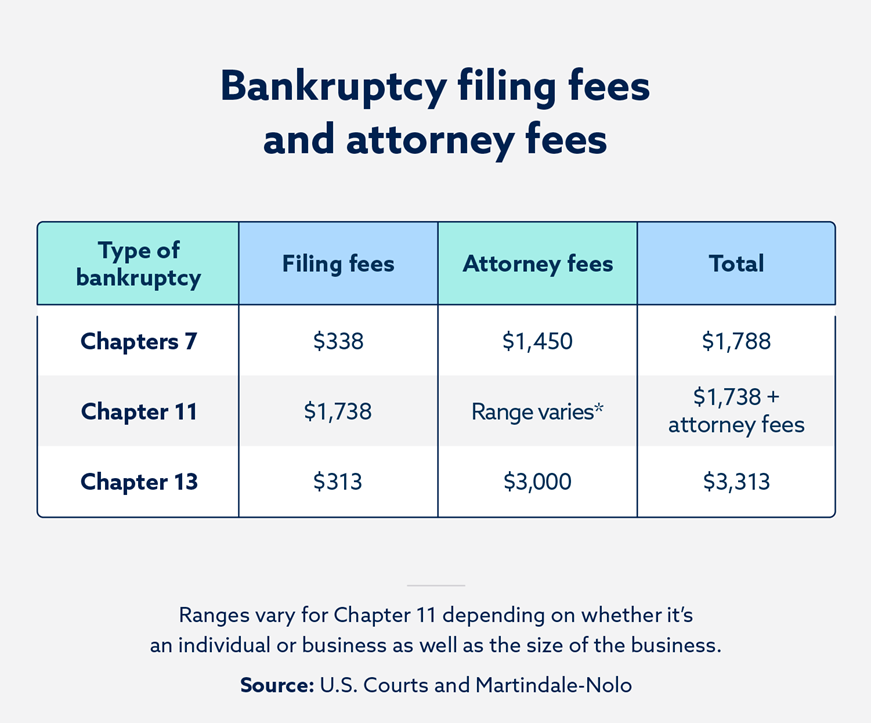

It can harm your credit rating for anywhere from 7-10 years as well as be a challenge towards obtaining safety clearances. If you can not solve your troubles in less than five years, insolvency is a practical alternative. Lawyer costs for bankruptcy vary relying on which create you choose, just how intricate your case is as well as where you are geographically. Tulsa OK bankruptcy attorney.Other insolvency expenses include a declaring cost ($338 for Chapter 7; $313 for Chapter 13); as well as costs for credit score counseling as well as financial management programs, which both price from $10 to $100.

You don't constantly need a lawyer when filing specific personal bankruptcy on your own or "pro se," the term for representing on your own. If the instance is basic enough, you can declare insolvency without aid. Yet the majority of people take advantage of representation. This write-up describes: when Chapter 7 is as well complicated to handle yourself why employing a Chapter 13 attorney is constantly crucial, as well as if you represent on your own, just how an insolvency petition preparer can assist.

, the order erasing financial obligation. Strategy on filling out substantial documentation, gathering economic documents, investigating personal bankruptcy and also exemption regulations, as well as complying with neighborhood guidelines and procedures.

Tulsa Bankruptcy Lawyer: Tips For Recovering From Personal Bankruptcy

Here are 2 situations that constantly call for representation., you'll likely want a lawyer.

Filers do not have an automatic right to dismiss a Chapter 7 case. If you slip up, the bankruptcy court could throw away your instance or offer possessions you assumed you might maintain. You can also face a personal bankruptcy legal action to figure out whether a financial obligation shouldn't be discharged. If you shed, you'll be stuck paying the financial debt after personal bankruptcy.

Filers do not have an automatic right to dismiss a Chapter 7 case. If you slip up, the bankruptcy court could throw away your instance or offer possessions you assumed you might maintain. You can also face a personal bankruptcy legal action to figure out whether a financial obligation shouldn't be discharged. If you shed, you'll be stuck paying the financial debt after personal bankruptcy. You could intend to submit Chapter 13 to catch up on mortgage arrears so you can keep your home. Or you could intend to eliminate your bank loan, "cram down" or lower a cars and truck lending, or pay back a financial obligation that won't go away in personal bankruptcy over time, such as back taxes or support financial obligations.

You could intend to submit Chapter 13 to catch up on mortgage arrears so you can keep your home. Or you could intend to eliminate your bank loan, "cram down" or lower a cars and truck lending, or pay back a financial obligation that won't go away in personal bankruptcy over time, such as back taxes or support financial obligations.In numerous visit their website instances, a bankruptcy attorney can swiftly recognize issues you may not detect. Some people documents for insolvency because they don't recognize their choices.

Bankruptcy Attorney Tulsa: The Pros And Cons Of Filing For Business Bankruptcy

For the majority of consumers, the sensible selections are Chapter 7 and Chapter 13 personal bankruptcy. Tulsa OK bankruptcy attorney. Chapter Tulsa bankruptcy attorney 7 can be the method to go if you have low income and also no possessions.

Right here are typical problems personal bankruptcy lawyers can avoid. Personal bankruptcy is form-driven. Lots of self-represented bankruptcy borrowers don't submit all of the needed insolvency documents, as well as their instance obtains dismissed.

If you stand to lose important residential property like your house, automobile, or various other home you care about, a lawyer might be well worth the money.

Not all insolvency cases continue efficiently, as well as other, a lot more complicated concerns can emerge. Many self-represented filers: do not understand the importance of movements as well as foe activities can not effectively protect versus an activity looking for to reject discharge, and also have a challenging time conforming with complex personal bankruptcy procedures.

Tulsa Bankruptcy Lawyer: Helping You Make The Right Choices

Or another thing might turn up. The lower line is that a lawyer is crucial when you discover on your own on the receiving end of a motion or claim. If you decide to file for bankruptcy on your very own, find out what services are available in your area for pro se filers.

, from sales brochures defining low-cost or free solutions to in-depth details about personal bankruptcy. Look for a bankruptcy book that highlights situations requiring an attorney.

You need to accurately complete several types, research study the legislation, as well as participate in hearings. If you comprehend insolvency regulation yet would such as help finishing the types (the standard insolvency request is about 50 web pages long), you might take into consideration hiring an insolvency request preparer. A personal bankruptcy application preparer is anyone or company, besides an attorney or someone that helps an attorney, that bills a fee to prepare insolvency documents.

Due to the fact that bankruptcy request preparers are not lawyers, they can't supply lawful suggestions or represent you in bankruptcy court. Specifically, they can't: tell you which kind of bankruptcy to submit tell you not to list specific financial debts tell you not to detail certain properties, or tell you what residential property to excluded.

Due to the fact that bankruptcy request preparers are not lawyers, they can't supply lawful suggestions or represent you in bankruptcy court. Specifically, they can't: tell you which kind of bankruptcy to submit tell you not to list specific financial debts tell you not to detail certain properties, or tell you what residential property to excluded.Report this page